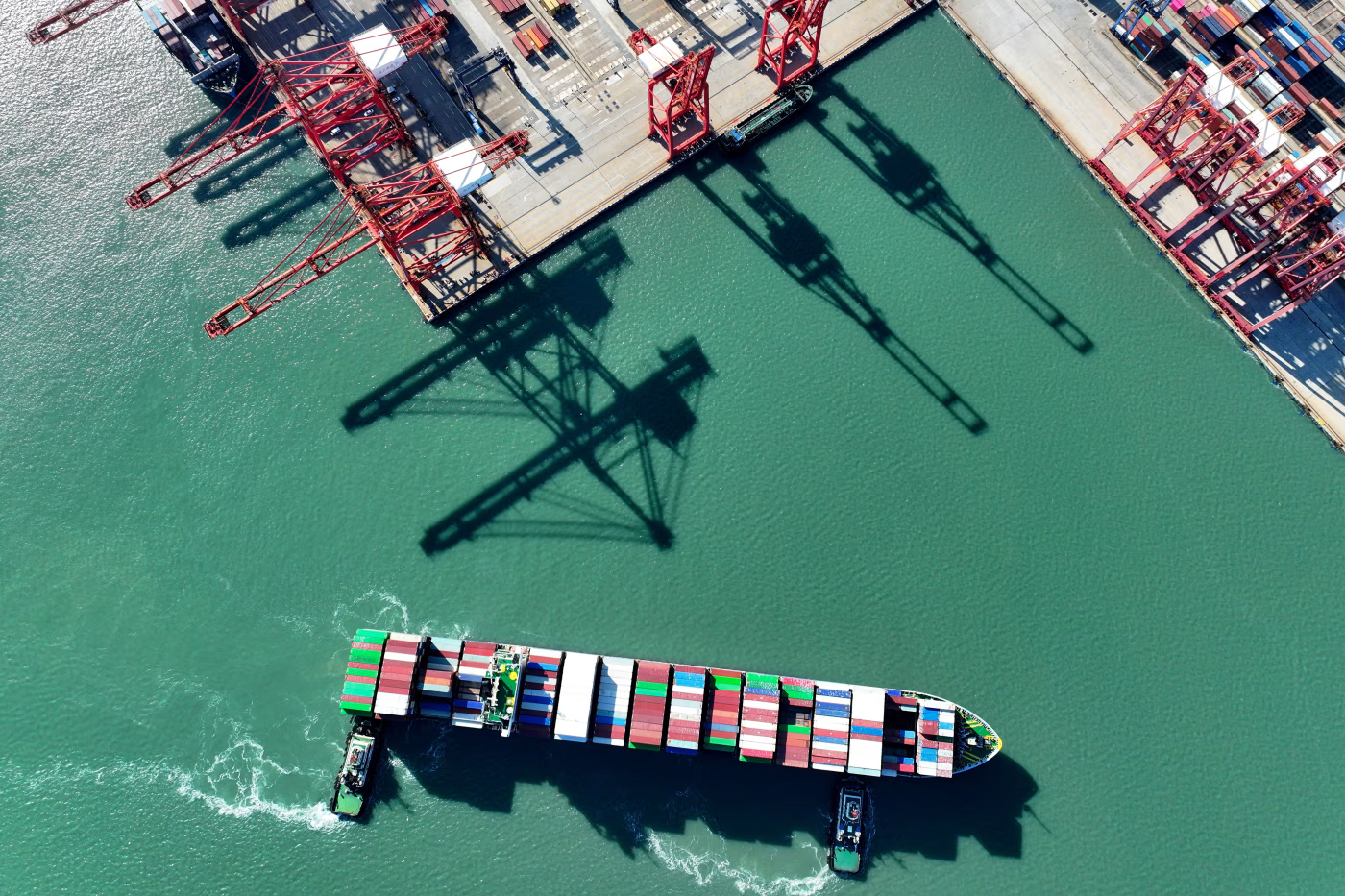

str/Agence France-Presse/Getty Images

China’s Economy Delivers 5% Growth in 2025 Fueled by Resilient Exports

Strong foreign trade performance has enabled Beijing to meet its growth targets, helping to offset weak domestic demand, subdued investment activity and the growing impact of global protectionism across key export markets.

China reported solid economic growth in 2025, with its **GDP expanding by about 5 %, meeting the government’s official target amid a challenging global environment. A central driver of this outcome was the continued resilience of the country’s export sector, which helped to offset sluggish domestic consumption, weak investment and persistent structural headwinds.

Exports and Trade Strength Above Expectations

Beijing achieved a record trade surplus of roughly $1.2 trillion in 2025, underpinned by a 5.5 % rise in exports and a significant increase in shipments to markets outside the United States—even as exports to the U.S. declined amid tariff pressure. This substantial surplus came despite renewed trade tensions with Washington, highlighting Chinese manufacturers’ ability to diversify into Europe, Latin America and Southeast Asia.

Official customs data show China’s total foreign trade in goods reached about 45.5 trillion yuan (approx. $6.5 trillion), with both imports and exports recording year-on-year increases. Chinese officials pointed to expanding global trade networks, broader engagement with Belt and Road Initiative partners, and growth in technology-intensive and green exports as evidence of deeper structural export competitiveness than in past cycles.

Domestic Weaknesses Persist

Despite the export-led resilience, China’s internal economy remains fragile. Key indicators reveal persistent weakness: retail sales growth slowed significantly, fixed-asset investment contracted for the first time in decades, and property investment continued its sharp multi-year decline. The population also shrank, intensifying long-term demographic challenges that weigh on consumer demand and labor market dynamics.

Industrial output remained among the few bright spots, with manufacturing growth outpacing overall GDP expansion. However, this output surge largely reflects sustained foreign demand and export orientation rather than broad-based domestic recovery.

Structural Imbalances and Policy Choices

Analysts caution that China’s reliance on exports masks structural imbalances within its economy. While strong external demand has provided a crucial growth buffer in 2025, it also underscores the economy’s vulnerability to geopolitical risk and global trade policy shifts. Increased tariffs and protectionist measures in major markets, particularly the United States, could curtail external demand in the coming years unless Beijing accelerates domestic rebalancing.

Fixed-asset investment’s contraction—driven in part by subdued local government spending and caution among private investors—adds another layer of complexity to China’s economic trajectory. Without a clear pick-up in domestic consumption and investment, the export-led model alone may not sustain robust growth over the medium term.

Policy Outlook and Strategic Priorities

China’s leadership has signaled efforts to pivot toward a “dual circulation” strategy that seeks to strengthen domestic demand while maintaining export competitiveness. This policy approach emphasizes self-reliance in key sectors, technological upgrading, and broader participation in global value chains—aiming to reduce vulnerability to external shocks while continuing to leverage China’s extensive trade networks.

Looking ahead to 2026, policymakers are expected to maintain targeted support for consumption and innovative industries, while keeping a cautious stance on broad stimulus measures. Official targets are likely to be more conservative, with growth forecasts in the 4.5 % range reflecting persistent structural headwinds and global economic uncertainty.

Investment and Market Implications

For investors, China’s 2025 growth report delivers a mixed signal: on one hand, export resilience sustains macro stability and supports industrial performance; on the other, domestic demand weakness and investment contraction present risks to long-term rebalancing and consumption-led expansion strategies. Equity markets and foreign direct investment flows will likely continue to respond to both external trade performance and domestic structural reforms as Beijing navigates complex global trade dynamics.

News

Opinion

WIN Membership

Customer Service

More